Small Business Accounting in California

How Do You Do bookkeeping for the small business(small business accounting in California)?

Breaking down Financial Transactions:-

The most common way of bookkeeping begins with breaking down financial exchanges and entering the ones relating to the business element into the bookkeeping framework. For example, advances taken for individual reasons are except for the small business accounting reports. The first step of the bookkeeping system includes the readiness of source reports. A source file or business report fills in as the organization for recording an exchange.

Diary Entries or Journal entries:-

Bargains on information in a magazine (anyhow known as Books of Original Entry) withinside the accompanying solicitation the use of the twofold place bills holder. The magazine regions are part of the information - price, and credit. To simplify this cycle, clerks use a splendid magazine to document rehashing trades, for instance, purchases, bargains, coins receipts, and so on the trades that can`t be related to the unusual journals recorded withinside the preferred magazine.

Record or ledgers:-

The overall record is a variety of records that show the progressions made to each record in light of past exchanges, alongside the current adjustments in each record

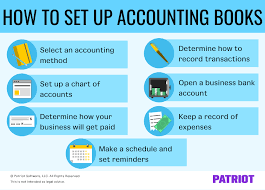

How Do I Set up a Small Business Accounting in California System?

Open a Business Bank Account:-

Whenever you start a business, open a different ledger that will keep your business funds separate from your ones.

Picking an Accounting Method:-

Small business accounting in California structure, Therefore, you want to choose a method for recording economic trades.

Cash-payment journal:-

Vision by group College was established in of dedicated people to provide made medical education

Recording Transactions:-

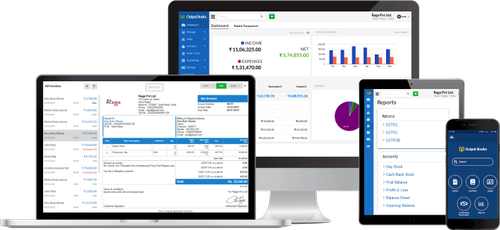

As a business visionary, you have the decision of selecting a clerk, recording trades the most difficult way possible, or using accounting programming to record your arrangements.

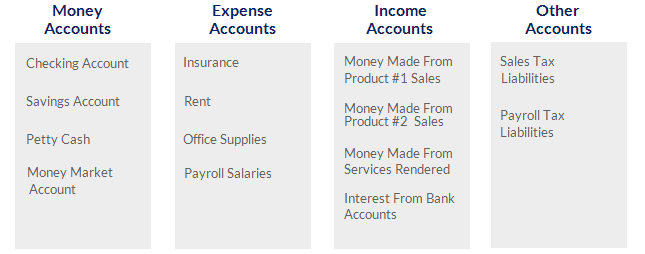

Incorporate a Chart of Accounts:-

A framework of records all arrangements and is used to assemble announcements, review progress. These layouts should be invigorated routinely to fuse various arrangements.

Decide your Payment Terms:-

On account of the possibility of your business, you could decide to offer credit to clients. As opposed to social occasion portions at the retail store.

Do You Need an Accountant for a Small Business Accounting

- Throughout the activity of your business, a bookkeeper can assist you with framing an alluring strategy

- Brief you on your business part structure

- Assist you with getting real licenses, for example, licenses to work deals charge grants, and work accounts

- Set up your bookkeeping programming and framework of records when you would rather not accomplish the accountant’s association on a common

- Direct consistency and complex plans charge issues

- Handle complex work costs including pay and work consistency gives that can sink even the most helpful affiliations.

- Assist you with meeting the basics for leasers or endorsing affiliations

- Remain mindful of stock records by dates bought, stock numbers, buy costs, dates sold, and deal costs

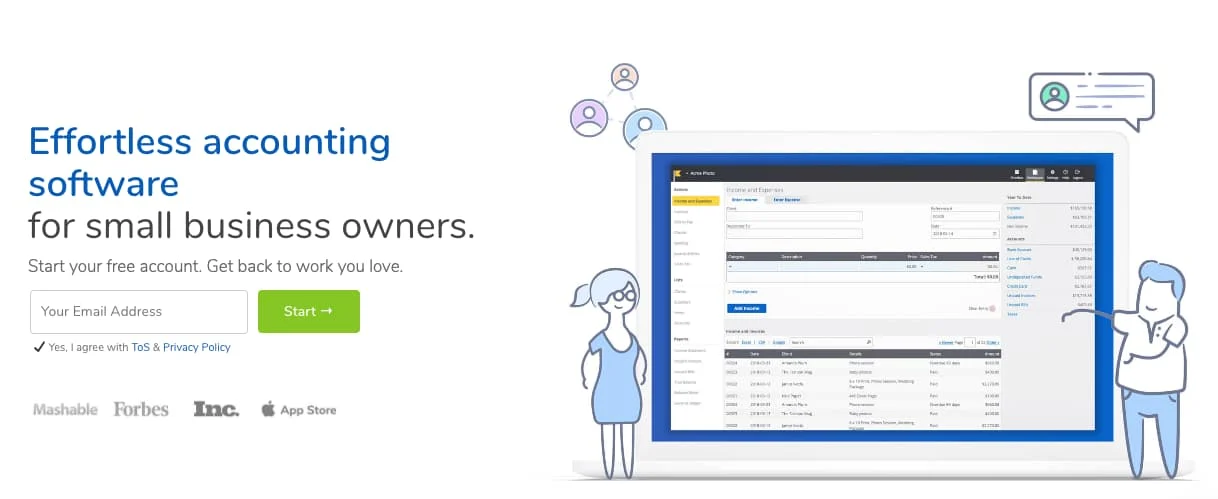

- Money managers who can’t endure enlisting an expert may meanwhile consider computerizing their free association bookkeeping rehearses with one of the many cloud-based bookkeeping programming applications.

info@accountingoutsourcehub.com

info@accountingoutsourcehub.com